FintechZoom GME Stock: A Deep Dive into the GameStop Phenomenon

Introduction: The Rise and Fall (and Rise Again) of GME Stock

FintechZoom GME Stock (GME) is no ordinary stock. What started as a struggling brick-and-mortar video game retailer quickly turned into the battleground for one of the most exciting and unprecedented market events in financial history. Thanks to retail FintechZoom GME Stock investors, social media, and a strong dislike for hedge funds, GME became a symbol of rebellion on Wall Street.

Platforms like FintechZoom provide valuable insights into such stocks, helping investors analyze price movements, trends, and predictions. But what exactly makes GME such a compelling stock? Let’s break it all down.

The GameStop Short Squeeze: How It All Began

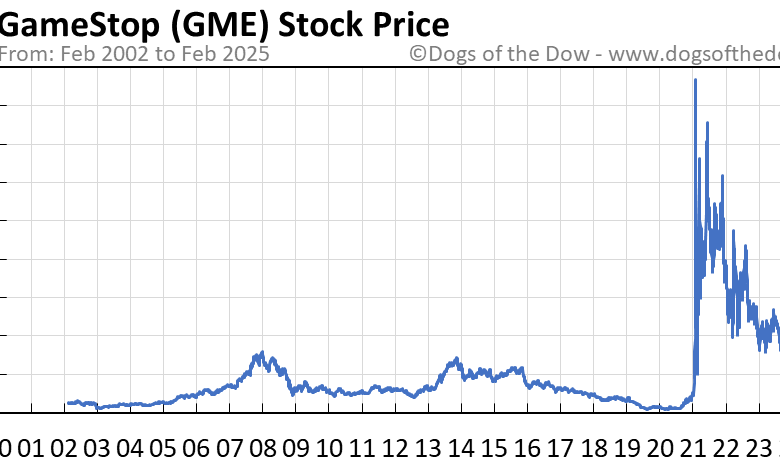

Before 2021, GameStop was a company on life support. With the rise of digital gaming, fewer people were visiting physical game stores, and the FintechZoom GME Stockcompany struggled to stay profitable. Big hedge funds saw this as an opportunity, placing massive short bets against the stock, essentially betting that GME’s price would fall further.

Then came retail investors, primarily from Reddit’s r/WallStreetBets community. They noticed how heavily GME was shorted and realized that if enough people started buying and holding the stock, they could trigger a short squeeze—forcing hedge funds to buy back shares at much higher prices. What followed was absolute chaos. The stock surged from around $20 to over $400 in a matter of days.

The financial world was stunned. Suddenly, a FintechZoom GME Stock group of everyday investors had turned the tables on Wall Street, costing hedge funds billions in losses. The event sparked debates about market manipulation, the power of retail traders, and whether the stock market was truly free.

FintechZoom’s Role in Analyzing GME Stock Trends

Platforms like FintechZoom GME Stock provide real-time financial data, stock charts, and analysis tools that help investors track stocks like GME. Whether you’re looking for historical price trends, technical analysis, or expert opinions, FintechZoom offers valuable insights.

Key Features of FintechZoom for GME Investors:

- Real-Time Stock Prices – FintechZoom updates stock prices instantly, allowing traders to make informed decisions.

- Technical Analysis Tools – Indicators FintechZoom GME Stock like moving averages, Relative Strength Index (RSI), and MACD help identify buy and sell signals.

- News Aggregation – The platform collects news from various sources to provide a comprehensive view of what’s happening with GME.

- Community Insights – Forums and discussions on FintechZoom allow investors to share their perspectives on stocks like GME.

For those actively trading or holding GME, FintechZoom GME Stock platforms like FintechZoom can be invaluable in tracking movements and making better investment decisions.

GME’s Volatility: A Rollercoaster Ride for Investors

If there’s one word to describe GME stock, it’s volatile. Since the initial short squeeze, the stock has gone through extreme ups and downs. Many traders made fortunes, while others saw their investments wiped out as the stock fluctuated wildly.

Factors Behind GME’s Ongoing Volatility:

- Retail Investor Hype – Platforms like FintechZoom GME Stock Reddit, Twitter, and YouTube continue to fuel excitement (or fear) around GME.

- Hedge Fund Strategies – Short-selling continues, though not to the extent of 2021’s squeeze.

- Company Fundamentals – GameStop has attempted to pivot into e-commerce and NFTs, but profitability remains uncertain.

- Broader Market Trends – Macroeconomic factors like interest rates and inflation impact meme stocks like GME more than traditional blue-chip stocks.

Despite all this, some investors still believe GME has potential, while others see it as a highly speculative asset. Either way, the stock continues to be one of the most talked-about on Wall Street.

Should You Invest in GME Stock?

This is the million-dollar question. Is GME a good investment? The answer depends on your risk tolerance and investment strategy.

Reasons to Invest in GME:

- Retail Investor Support – The stock remains a symbol of the power of retail traders, and strong community backing can lead to sudden price surges.

- Potential Turnaround – If GameStop successfully transitions into a profitable digital business, its stock could see long-term growth.

- Short Squeeze Potential – Some FintechZoom GME Stock investors believe another squeeze could happen if conditions align.

Reasons to Avoid GME:

- High Volatility – The stock is unpredictable, making it risky for those seeking stable investments.

- Fundamental Weakness – GameStop’s core business struggles to compete in a digital marketplace.

- Regulatory Concerns – Increased FintechZoom GME Stock scrutiny on meme stocks and trading platforms could impact trading strategies.

If you’re considering buying GME, it’s essential to do thorough research, use tools like FintechZoom to track trends, and never invest more than you’re willing to lose.

Conclusion: The Legacy of GME Stock

GameStop’s story is far from over. Whether it remains a meme stock or transforms into a legitimate long-term investment, it has already changed the way retail investors approach the stock market. The events of 2021 proved that everyday traders can influence markets in ways never seen before.

FintechZoom and similar platforms continue to provide valuable insights into stocks like GME, helping traders navigate the complex world of finance. Whether you’re a seasoned investor or just someone watching from the sidelines, one thing is clear—GME is a stock that refuses to be ignored.